A Rocky Road for Bitcoin Past the $35k Threshold

Veteran market pundits are forecasting a tough route ahead for Bitcoin as its advances beyond $35,000. Established trading firm, QCP Capital, suggested in their recent market extrapolation on July 5 that the Bitcoin value growth may stall around the mid-$30,000 area.

Stagnation Fears As Bitcoin Hovers Near the $30k Mark

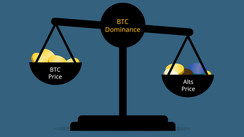

As Bitcoin's price oscillates around the $30,000 mark, anxieties are growing over the possibility of it having already reached its lion's share of price growth. Industry players are keeping a keen eye on the $35,000 to $40,000 sector, seeking to identify a temporary maximum. QCP Capital aligns with this viewpoint, advising a short-term approach of trading late September 33k to 35k calls for 30k puts.

Technical Markers Signal $35k Hurdle

QCP Capital pinpointed potential resistance for the MACD (moving average convergence/divergence) parameter - a method used to gauge price robustness at particular stages within a market trend - at the $35,000 milestone. They further indicated that any upswing from this point might constitute a final 5th wave from the lows of November's FTX. Correspondingly, this hurdle coincides with the MACD confronting a three-year triangle resistance.

Uncertain Macro Economic Atmosphere Persist

Present macroeconomic circumstances could maintain market steadiness, partly due to the unwavering position of the U.S. Federal Reserve. Despite facing a downward spiral of inflation, authorities resolve to persist with the planned interest rate augmentations for the year. Predictions postulate an inflation rate around 3-4% persisting until year's end, hinting at a likely nominal macro influence on the sector.

Potential Changes Sparked by Bitcoin Spot-Based ETF Approval

QCP Capital asserts that no swift decision is anticipated on America's first Bitcoin spot-based exchange-traded fund (ETF), a factor that could bring a significant upswing to Bitcoin's pricing. Yet, the day's gossips also hint at a looming Bitcoin price adjustment.

Bitcoin Prices Under Strain as Binance Confronts $30 Million Query

Reflexivity Research's co-founder, William Clemente, contributes data implying a lack of universal optimism among future traders for Bitcoin. Another industry player, Keith Alan of Material Indicators, aired his doubts about an imminent pullback as a novel resistance block materialised on the Binance order volume at the $36,000 point. Bitcoin was being traded close to $30,800 when the report was filed.