Bitcoin's Price Slide Triggers Massive Liquidation

Bitcoin's price crumbled under its 55-day support level of $27,000 on May 12, triggering a two-day, 7% drop to $26,155. This downturn forced a $100 million liquidation of long BTC futures contracts. Nevertheless, the resilience exhibited by Bitcoin's margin and futures markets during this slump is fostering optimism for a rally towards $28,000.

The Impact of Regulatory Hurdles and a Stronger U.S. Dollar

The regulatory landscape in the United States has become murkier following the receipt of another subpoena by Bitcoin miner Marathon Digital. The mining firm, listed on the stock exchange, alerted its shareholders on May 10 about the subpoena from the U.S. Securities and Exchange Commission (SEC), raising concerns about potential violations of federal securities laws due to its involvement in related-party transactions.

Adding to the prevailing risks is the 627,522 Bitcoin held by Grayscale Bitcoin Trust, which has been at a significant discount for over a year. Grayscale's parent company, Digital Currency Group (DCG), is dealing with the fallout from some failing subsidiaries. DCG's crypto lending and trading firm, Genesis Capital, sought Chapter 11 bankruptcy protection in January.

Despite distinct corporate entities, Genesis had "intercompany obligations" with DCG, leaving the impact on the Grayscale funds' administration uncertain. Moreover, the group purportedly owes around $900 million to clients of Gemini, and both Genesis and Gemini faced charges from the U.S. SEC in January.

Bitcoin's 7.2% slide coincided with a surge in the U.S. Dollar Strength Index (DXY), which gauges the U.S. currency against an array of foreign currencies. The index hit 101 on May 8, close to its 12-month low, reflecting diminished faith in the government's capacity to rein in inflation while raising the debt limit.

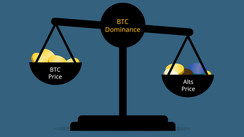

Bitcoin typically shows an inverse correlation with the DXY index, as a weaker dollar boosts demand for alternative value stores and scarce assets.

Derivatives Metrics and Market Positions

To gain a clearer picture of professional traders' positioning, it's vital to examine derivatives metrics.

Market Resilience Post-Bitcoin Crash

To rule out factors solely affecting margin markets, we should consider the long-to-short metric. This measurement aggregates data from clients' positions on spot, perpetual, and futures contracts across exchanges, providing a comprehensive view of professional traders' positions.

Despite Bitcoin breaking the $28,000 support, professional traders have ramped up their leveraged long positions via futures, as shown by the long-to-short indicator.

Hence, even with the 12% price fall from the May 6 high of $29,865, traders employing margin and futures contracts haven't deserted their bullish stance. This trend signals confidence in Bitcoin's potential to regain the $28,000 mark rather than capitulate to the next support level around $24,500.