Bitcoin: On the Brink of a Major Drop?

Bitcoin may be gearing up for a substantial price reduction based on the observations of James Straten, a data analyst at the crypto analytics company, CryptoSlate. Notably, Bitcoin's Short to Long-Term Realized Value (SLRV) Ratio reversed its trend first observed in November 2022, painting a potentially grim picture for the near future of the digital coin.

SLRV Ratio: A Warning for Bitcoin

The potential for a dip to $23,000 in BTC's price has market spectators on high alert. However, in retrospect, Bitcoin's decline in August would have seemingly invoked greater consequences had things been different.

A surge in the sale of older Bitcoins occurred around mid-August, as indicated by SLRV Ratio. Created by renowned analyst David Puell and ARK Invest, SLRV applies the widely used HODL Waves metric to measure Bitcoin's on-chain speed.

Understanding the SLRV Ratio Indicator

HODL Waves segregate the Bitcoin supply in circulation based on the age of coins used in transactions. SLRV's analysis involves dividing coins which moved in the past 24 hours by those that moved between six and twelve months prior.

These metrics also encompass two momentous averages — the 30-day and 150-day trendlines. Significant crossovers between these averages have corresponded with noteworthy moments in Bitcoin’s price history.

Interestingly, three days before BTC plummeted to $25,000 in mid-August, the regions under study on the SLRV indicated an inversion. The last such inversion was witnessed before the epic FTX crash.

Unpacking Bitcoin Investor Behavior

Recent analyses have focused on the behavior of specific Bitcoin investor groups, especially short-term holders (STHs), who hold their BTC for 155 days or less. These STHs, who are often likened to speculators, dispose of their inventory at a loss, which has been a significant activity since the end of August.

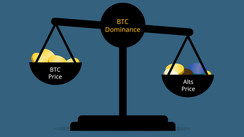

It's noteworthy that the cost basis for short-term holders – the cumulative price at which they amassed their proportion of the Bitcoin supply – which once served as a market buffer, is no longer providing this support. Currently, this basis is higher than the on-the-spot price of Bitcoin, as shown by the selling trend by speculators.

Furthermore, according to CryptoQuant data, there are insights into the prices at which different coins were last transported in transactions. It is highly advisable for investors to conduct their own meticulous analysis before making any decisive moves in this volatile market.