Trend Following trading systems provide some of the best and most profitable trading opportunities in Cryptocurrencies and Bitcoin.

As the name suggests, in this strategy I trade in the main direction of the market - so I simply go in the direction of the price moves. This is always an advantage as I don't care about the real value of Bitcoin or other Cryptocurrencies, but I simply trade in the direction of price.

Thanks to this strategy, most of the time I am on the right side of the market

How to analyze the trend of Bitcoin:

To analyze the main trend, I use weekly and daily time frames - daily is my favorite so I use the D1 chart most of the time.

Then I use naked Price Action to analyze the market moves and the interactions with trend lines, trend channels, and market swings. However, if you are not much familiar with these techniques, then you can use indicators like Moving Average as well (only make sure to understand that the Moving Average indicator is little lagging due to its calculation and averaging price movements).

Don't try to find anything hard behind my strategy, it's time-proven technical analysis technique that is simply making money. I'm going to show you how I exactly trade this strategy by following charts.

Highly Profitable BTC Opportunities by Using Trend Line Only

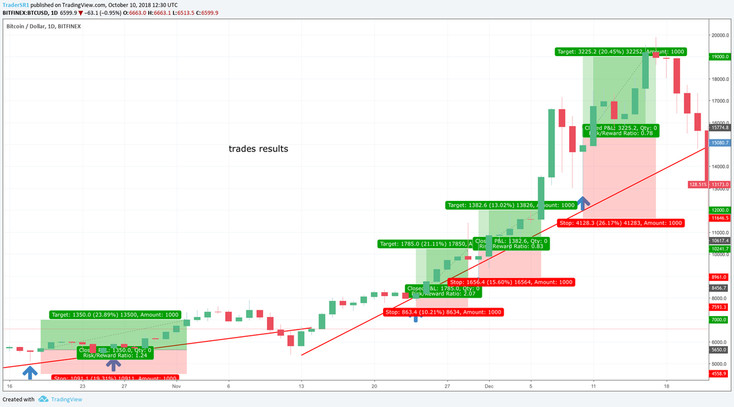

Below you can see how I traded Bitcoin when it was clearly rising and when it was in a very nice bullish trend. I simply draw the trend lines that you can see below and every time BTC touched my trendline and made a corrective move to the trendline, I bought as soon as the breakout of such candle happened.

My Stop-Loss was always below the trend line and Take-Profit was the second closest round number. Let's have a look at an example of the Take-Profit.

I bought BTC at $8,450, the closest round number price level is $9,000 and the second closest round number is $10,000. And that's all my magic that made me huge returns and profits.

You can see my trades results below - only in case of the last market BUY trade, the volatility was very high (when Bitcoin was near its maximum), so my Stop-Loss had to be much higher and that's why my Take-Profit was the 4th round number. I bought at $15,800 and the 4th nearest round number price level is $19,000 and this was my Take-Profit. However, I don't recommend such a big Take-Profit in a standard situation - this was only due to the huge volatility of Bitcoin at that time.

Also, note how I redraw the rising trendline as it was once broken (highlighted by the first arrow in the chart below), but BTC made new higher high - so I knew that we are still in an uptrend and that I should still go with BUY trades.

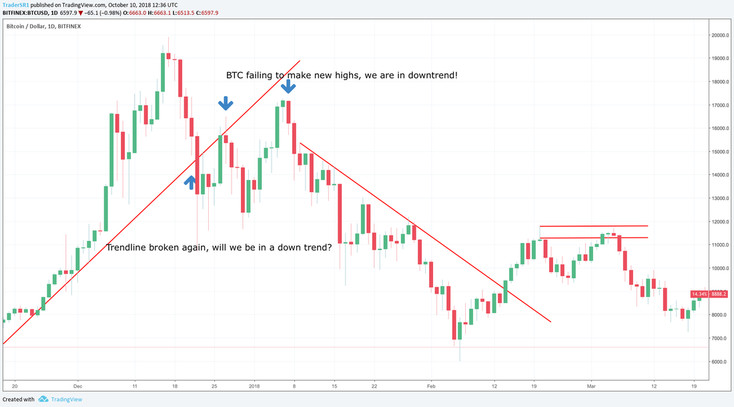

But then the bullish trend of Bitcoin was really broken, and I wait a while to see if the bearish trend will be confirmed or not. And it really was! So I began my downside ride.

And the same scenario - only vice versa - occurred. I was selling BTC every time it reached the bearish trend line. The Stop-Loss was again above the trend line and the Take-Profit was the second nearest round price level. Nice profit was still generated on my Crypto account!

100% universal and profitable strategy

This is 100% universal, adaptive and highly profitable trading strategy. As you can see below, the bearish trendline was broken once again. What do you think? Are we in an uptrend again? I always want the market to tell me - to confirm it. That's why I waited and the next swing told us that NO, we are not in the bullish trend, but we should short Bitcoin again! Another nicely profitable trade was closed and more came soon.

What if there is no trend?

Remember this: in every market that you are going to trade, there can be an uptrend (bullish trend), downtrend (bearish trend) or no trend (sideways trend). The sideways market can look in various ways. If it's a classical sideways market, then you can trade every bounce from the bottom to the upside and from the top of the range to the downside. It's also called range trading.

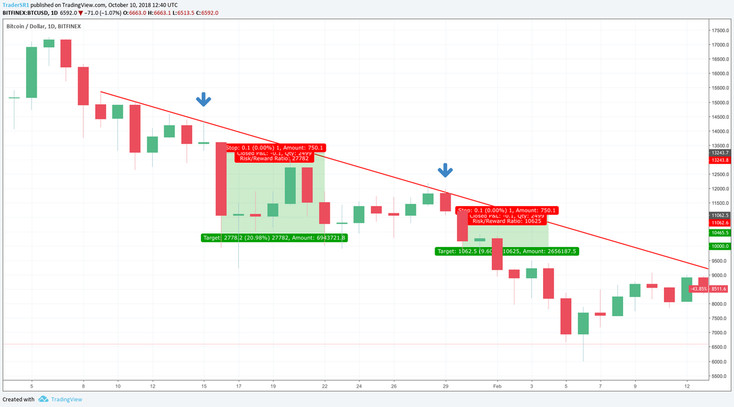

But the sideways trend can also look like a triangle - as you can see on the Bitcoin chart below.

In this strategy, I don't care if the market is going up or down, but I simply go with the direction of the market. Range breakouts are great opportunities as well, I have a strategy for range breakouts as well and I will describe this in a future article.

Take care and trade well!