Bitcoin Faces Uncertain Market Amid Bearish Divergence

Bitcoin has embarked upon a new week, tentatively holding onto the $30,000 benchmark. A creeping sense of a “bearish divergence” is permeating the market following a quiet weekend. As Bitcoin’s overall bullish performance undergoes a potential retracement phase, traders are left contemplating what might be in store for the week.

Intriguing Dynamics in U.S. Bitcoin Market Could Ignite Volatility

The reintroduction of exterior levers into risk asset management, combined with an influx of significant macroeconomic data from the United States and multiple Federal Reserve official speeches, heralds a potential period of unrest. Factor in intriguing aspects of the U.S. Bitcoin market, and there is room for pronounced volatility this week.

Traders Eagerly Eye Bitcoin Price Dip Amid Weak $30,000 Support

Despite Bitcoin concluding the week just above $30,000, as indicated by data from Cointelegraph Markets Pro and TradingView, the resilience of this figure now seems questionable. Speculation of a retracement period precedes the resumption of an upward trajectory, according to market observers. Bitcoin’s ripple into the $20,000 territory, occurring immediately after the weekend close, has only boosted such speculation.

Major Macroeconomic Updates Anticipated as Fed Leaders Speak

Macroeconomic analysts are gearing up for a busy week, led by the release of the Consumer Price Index (CPI). A downward shift in inflation, as indicated by the CPI, would diminish the persisting watchfulness of a hawkish Fed. Majority consensus suggests that interest rates will witness another hike, post a momentary suspension last month, but data beating trends could incite late-stage doubts.

Bitcoin Mining Difficulty Matches Hash Rate Growth

In a marked reversal, Bitcoin network fundamentals are slated to break new records this week. Forecasts from BTC.com suggest the network will witness an upsurge of nearly 5% in its difficulty level – the biggest single upward modification since late March. Given the plateaued price action, this bears significance, for it testifies to a continued rivalry in the mining segment and renewed faith in future profitability.

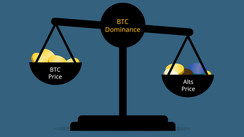

Falling Bitcoin Supply Stirs Talk of Supply Shock

The recent filings for United States-based Bitcoin ETFs have triggered an acquisition surge. As U.S. market activity steps up, jostling with Asia for Bitcoin supply dominance, the implications for the dwindling supply become increasingly evident in the longer term. With merely 7.5% of Bitcoin's unalterable 21 million coins remaining for mining, the scope for a supply shock is evident.

Large-Scale Investors Increase Bitcoin Exposure

Not just miners, but major Bitcoin investors, or 'whales,' are demonstrating confidence in the currency's future profitability as well. As per data analysed by Santiment, big volume Bitcoin investors have shown no signs of dipping purchases amidst a plateaued BTC price.

.