Bitcoin's Performance Overview

Despite 2023 beginning optimistically for Bitcoin (BTC) with an approximately 80% surge, the digital asset faced a slight setback in the third quarter with an estimated 11% dip. Encouragingly, Bitcoin bulls managed to end September on a positive note, marking the first occurrence since 2016. Bitcoin enthusiasts are keen to maintain this momentum throughout October, a historically favorable month for the cryptocurrency. Based on historical data from CoinGlass, only in the years 2014 and 2018 has October produced adverse returns for Bitcoin since 2013. This data provides a strategic starting point for traders though it doesn't guarantee future performance.

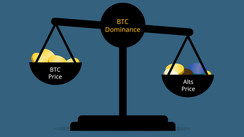

Bitcoin's recent resilience has also sparked interest in altcoins. Certain altcoins are currently striving to propel beyond their overhead resistance levels, hinting at the commencement of a significant recovery. The bullish momentum could potentially intensify if Bitcoin's relief rally soars to $28,000.

Detailed Insight into Top Performing Cryptocurrencies

Not all altcoins are projected to surge to higher levels. The cryptocurrencies displaying strength are the ones that could primarily steer the recovery higher. Let us delve into the chart analysis of the top 5 cryptocurrencies that may perform exceptionally in the near term.

Bitcoin Price Analysis

The price of Bitcoin has continued making strides above the moving averages starting from September. This trend is a good indicator for the buyers. However, persistent resistance from bears is met at approximately $27,500, though it's important to note that the bulls consistently hold their ground, implying the careful purchase of each minor dip. This tactic enhances the odds of overcoming the $27,500 mark. At that point, the BTC/USDT pair may confront resistance at $28,143, a level known to have attracted intensive bear selling previously.

Maker (MKR) Price Analysis

The promising altcoin possesses an impressive track record, with a clear bullish trend evident in its charts. On 26th September, Maker (MKR) closed at over $1,370, indicative of a new upward trajectory. The $1,600 mark was a slight challenge, but the dip to $1,432 was a buying opportunity for the bulls. If Maker continues this upward journey, crossing $1,600 could lead the MKR/USDT pair to rise to $1,760, eventually approaching $1,909.

Aave (AAVE) Price Analysis

Aave (AAVE) has displayed attempts to overcome the long-term downtrend line, pointing to a potential trend alteration. The rebound off the 20-day EMA from Sep. 28 signals a change in investor sentiment, moving from selling upon rallies to buying during dips.

THORChain (RUNE) Price Analysis

THORChain (RUNE) has consistently hit the overhead resistance at $2. This repeated retesting of a resistance level often weakens it, increasing the prospects of a rally escalating beyond the $2 parameter.

Injective (INJ) Price Analysis

Injective (INJ) has swung within a broad range of $5.40 and $10 over the last few days. The erratic price movements within this range can provide trading opportunities given the relatively wide range boundaries.